IceniCAM News Archive

2014

Roadworthiness testing

November 2014

The EU Directive on

roadworthiness testing has been adopted and is binding on all

EU Member States, including

the UK. Nothing changes

yet, the Government is working on how the Directive will

applied. That will involve two separate exercises, one in

Great Britain and one in Northern Ireland, because NI has its own, devolved, testing

scheme.

While the directive allows for exemptions for historic

vehicles, the definition of ‘historic’ in the

directive prohibits ‘substantial modification’ and

it’s uncertain quite what counts as a modification when a

vehicle is restored. The DfT shold be starting a formal

consultation next year, and the Directive has to be implementated

by 2018.

Most of this has been extensively reported over the past

months ... but what is seldom mentioned is that it does not apply

to motor cycles. Motor cycle testing does not have to

comply until 2021 and, even then, Member States will have much

more national discretion over their testing regime ... currently,

motor cycles are not tested at all in some EU countries.

VED refunds

November 2014

DVLA no longer

accepts V14 forms applying for a vehicle tax refund. They

will be rejected and returned.

Since 1 October 2014, you no longer need to make a separate

application on a V14 for a refund of vehicle tax.

DVLA

automatically issues a vehicle tax refund when a notification is

received from the registered keeper that the:

vehicle has been sold or transferred

vehicle has been scrapped at an authorised

treatment facility

vehicle has been exported

vehicle has been removed from the road and the

person on the vehicle register has made a SORN

registered keeper has changed the tax class on

the vehicle to an exempt duty tax class

Customers should make sure that the dates of acquisition and

disposal provided on the notification, using the vehicle

registration certificate (V5C or logbook), V5C/2 and V5C/3, are

accurate. Incorrect information will affect the amount of

refund calculated.

Myford cyclemotor

September 2014

Hi folk,

The next issue of Model Engineer

magazine (issue 4490 which is due in shops next week) contains a

piece by John Stevenson about the work of the Jones brothers and

the Myford Cyclemotor. This info is also noted on the

magazine’s cover to make life easier for old folk as

myself!

Regards

Jim Switzer

AOTD

July 2014

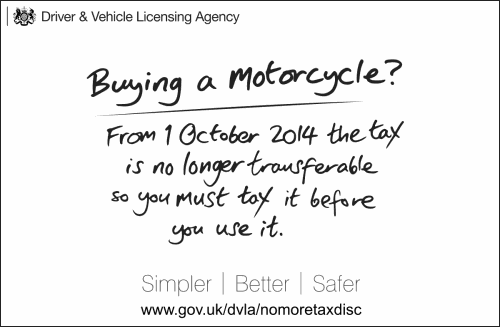

The law is changing to get rid of the need to display a paper

tax disc; the DVLA and police

now rely on DVLA’s

electronic vehicle register to check if a vehicle is taxed.

The change will be introduced on 1st October 2014 and applies to

everyone who needs to tax their vehicle. Motorists will

still need to pay for their vehicle tax, but they will no longer

get a paper tax disc for display on vehicles. The

requirement to apply for vehicle tax will not change for vehicles

that are exempt from payment of vehicle tax (eg: Hstoric

Vehicles). The only change will be that the paper tax disc

will no longer be issued and required to be displayed on a

vehicle windscreen. Motorists still get a reminder when the

vehicle tax runs out; there will be no change to the issue of the

Renewal Reminder (V11s and V85/1s). Any person may check

the tax status of any vehicle by using DVLA’s

Vehicle Enquiry System. The vehicle enquiry system can be

accessed by visiting www.vehicleenquiry.service.gov.uk.

Anyone who notifies DVLA that they no

longer need to tax the vehicle any longer such as it being sold,

transferred, or declared off the road (SORN), will recieve a

VED refund

automatically. There’s more information on the

DVLA

website at www.gov.uk/dvla/nomoretaxdisc

Dave Bickers

July 2014

We’re sad to have to report the death of Dave Bickers on

Sunday 6th July. Dave was probably the best-known motor

cyclist of his era thanks the televisation of the sport he

excelled at: Moto Cross (or Scrambles as we used to call it in

those days). Dave also made a name for himself in show

business circles, providing ‘action vehicles’ for any

films including, for example, the Indiana Jones films. In

contrast to these ‘exalted circles’ Dave was often

and local motor cycle events and was a regular rider on

EACC

DVA

NI

July 2014

Application for an Age Related Mark (V3) Scheme in Northern

Ireland

The V3 scheme has, along with all the services and processes

currently provided by DVA NI, been reviewed by DVLA as part of

the NI/GB merger. As a result, they intend

to introduce the following changes:

The requirement for an historic NI import with a foreign logbook to be

supported by the Association of Old Vehicle Clubs (AOVC)

ends when DVA

From 21st July, NI imports with a foreign logbook will

be processed in GB without the

V3 form. Vehicles manufactured in 1975 or before will be

allocated an older style NI

vehicle registration mark (VRM).

From 21st July NI imports with a dating certificate

(vehicle manufactured in 1975 or before) will be allocated an

older style NI vehicle

registration mark. All older style VRMs will be issued on a

non-transferable basis.

Vehicles manufactured in and after 1976 will be

allocated a current NI

vehicle registration mark

Historic vehicles with no documentation will be allocated a

QNI vehicle registration mark.

The V3 application form will be removed from general circulation

as soon as possible. DVA will continue to accept

and where possible, process V3 applications up until 17

July. After this date any application to register a

historic vehicle, imported into NI supported by a foreign logbook

should be sent to:

DVLA,

Swansea,

SA99 1BE

The V3 will not be required.

DVA

NI

June 2014

The DVA in

Northern Ireland is due to close in July, with its work being

transferred to DVLA

Swansea. Until now the procedure for V765 applications in Northern Ireland has been

somewhat different from in the rest of the UK. Furthermore, Northern Ireland

doesn’t issue any ‘age-related’

registrations. So, will this change when DVLA takes

over? No one seems to know...

Historic Tax

April 2014

From 1st April, vehicles built before 1st January 1974 qualify

for the zero-rated Historic Vehicle tax ... but ...

The Historic tax rate won’t be applied automatically to

the newly qualified vehicles; you’ll have to apply for

it. You don’t have to wait until the current tax disc

expires. On the ‘changes’ section of the V5c

put the tax class as ‘Historic Vehicle’, then sign

& date it. Fill in a V10 to

apply for a new tax disc and take it all to a Motor Tax Post

Office, along with the current MoT. The Post Office will give you a new tax

disc, retaining the V5c, which they’ll send on to

DVLA. The

remaining duty on the unexpired old tax disc can be reclaimed

using form V14.

Budget 2014

March 2014

As expected, a rolling 40-year Historic VED was part of this

year’s budget. Another item that was expected was the

legislation needed to abolish tax discs. Perhaps less

welcome for classic vehocle owners is that there will be a

financial incentive for increasing the methanol in fuel from

April next year. Here’s the small print from the

Budget document:

2.151 Fuel duty incentives for methanol—

From April 2015, the government will apply a reduced rate of fuel

duty to methanol. The rate will be set at 9.32 pence per

litre. The size of the duty differential between the main

rate and methanol will be maintained until March 2024. The

government will review the impact of this incentive alongside the

duty incentives for road fuel gases at Budget 2018.

(Finance Bill 2015)

2.152 Vehicle Excise Duty (VED) rates and

bands—

VED rates for cars, motorcycles and the main rates for vans will

increase by RPI from 1 April 2014. (Finance Bill 2014)

2.153 VED: classic vehicle exemption –

The government will introduce a rolling 40 year VED exemption for

classic vehicles from 1 April 2014. (Finance Bill 2014 and

future Finance Bills) (39)

2.154 VED administrative simplification—

As announced at Autumn Statement 2013, the government will

introduce legislation to reduce tax administration costs and

burdens by making the following changes with effect from 1

October 2014:

— motorists will be able to pay their VED by direct

debit annually, biannually or monthly, should they wish to do so.

A 5% surcharge will apply to biannual and monthly payments

(Finance Bill 2014) (c)

— a paper tax disc will no longer be issued and

required to be displayed on a vehicle windscreen (Finance Bill

2014)